- 2290 Amendments

- VIN Correction

- Taxable Gross Weight Increase

- Suspended Vehicle Mileage Exceeded

- Timing

In a few minutes, you'll have the Form 2290 amendment filed and completed.

Form 2290 Amendments

If you own and operate a heavy highway motor vehicle with a taxable gross vehicle weight of 55,000 pounds or more that is used on a public highway in the United States, you are required to file Form 2290 and pay the associated excise taxes each year. But what happens if your circumstances change during the year or the original 2290 filling has a mistake? That's where 2290 amendment filings come in - they allow you to make changes to your original Form 2290 filing. Learn more about filing a Form 2290 amendment online. Stay compliant and keep your business running smoothly with 2290Trucking.com!

Can a Form 2290 be amended?

There are three types of 2290 amendments that can be filed online.

- VIN Correction

- Taxable Gross Vehicle Weight Increase

- Suspended Vehicle Exceeds the Mileage Limit

How do I file a 2290 VIN Correction?

Here are the simple steps to file a VIN Correction amendment for the Form 2290. A VIN Correction amendment is filed if your original Form 2290 filing has a typo or incorrect vehicle identification number submitted on the original Form 2290 filing with the IRS.

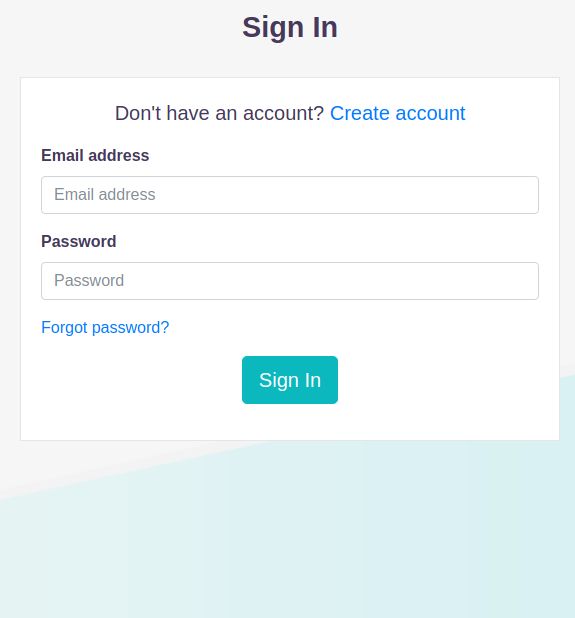

- Log in

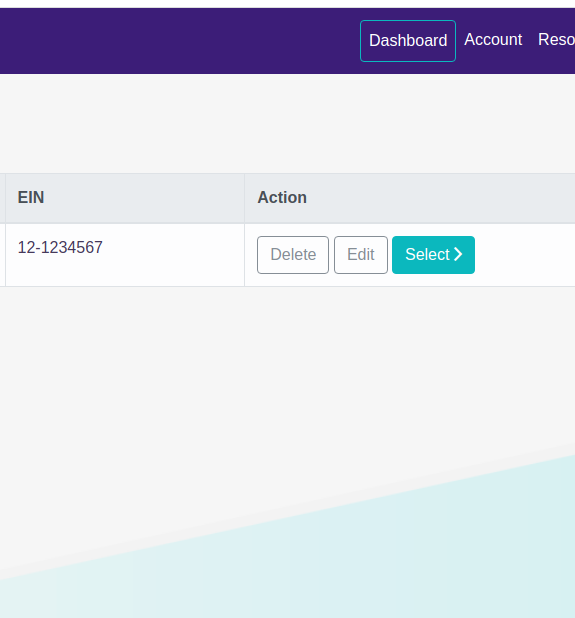

- Click on the Select button for the appropriate business

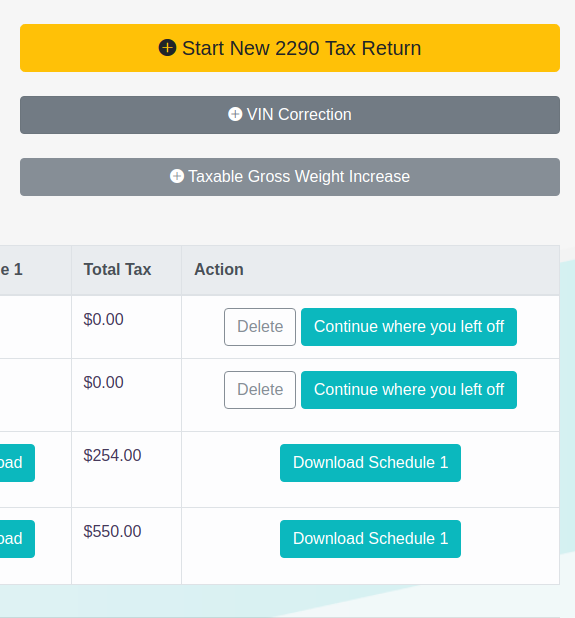

- Click on the grey VIN Correction button in the upper right section of the screen

- Complete the VIN Correction and submit it to the IRS

- You will have your corrected Schedule 1 back within 15 minutes

How do I file a Taxable Gross Vehicle Weight Increase Amendment?

If you need to increase the taxable gross vehicle weight on one or more of your vehicles, you can file a Taxable Gross Vehicle Weight Increase Amendment for Form 2290. For example, if you were to increase the maximum load customarily carried on the truck, the taxable gross weight would increase requiring the weight category to be updated on the Form 2290 filing.

- Log in to your account

- Click on the Select button for your business

- On the next screen, in the upper right you will see 3 buttons. Click on the Taxable Gross Weight Increase button

- Fill in your tax information

- Transmit to the IRS

You'll have a new watermarked Schedule 1 with the corrected weight category in minutes.

Step 1

Step 2

Select the apprpriate business

Step 3

Click on the grey "Taxable Gross Weight Increase" button

How do I file a Suspended Vehicle amendment that has exceeded the mileage use limit?

If you filed a Form 2290 with a suspended vehicle but the vehicle has now exceeded the mileage use limit for the current filing period, you can file a new 2290 return amendment. This will update the status of your vehicle from a suspended vehicle to a taxable vehicle. Suspended vehicles are vehicles that have been used on public highways that do not exceed 5,000 miles or 7,500 miles for agricultural vehicles during the tax period. These suspended vehicles are not taxed by the IRS.

File the new 2290 return by the following month when the vehicle exceeds the limit. For example, if you originally filed a Form 2290 with a July month first used date and the suspended vehicle exceeds the mileage limit in August, you need to file the 2290 amendment by the end of September for the remaining months in the tax period that ends in June. Our system will automatically calculate the prorated heavy vehicle taxes due to the IRS.

How long does it take IRS to approve a 2290 amendment?

2290Trucking.com can get your 2290 amendment filing processed directly with the IRS in 15 minutes! Once our team gets the 2290 amendment filed and approved with the IRS, you will receive an email notification with a new watermarked Schedule 1 that includes the amended vehicle information. You can also log in to your 2290Trucking.com account to view and download your updated Schedule 1 at any time.

How can I get help filing a Form 2290 amendment if needed?

If you have any questions while filing your Form 2290 amendment, our customer service team is available to help. You can contact us and one of our friendly support specialists will be happy to answer all your questions! We are here to make sure your 2290 amendment filing process is easy, fast and accurate.